Cryptocurrency Aml Worldwide Regulations

Financial institutions and banks around the world are already subject to AMLCTF regulation and KYC for fiat currency to mitigate the related risks but they also have to mitigate crypto risks from their crypto exposure. The IFWGs position paper has recommended the government to introduce enhanced AMLCFT requirements for crypto asset service providers.

The 2021 Guide To Aml And Kyc For Crypto Exchanges Wallets Getid

In some places around the world cryptocurrencies are not under any regulations or they.

Cryptocurrency aml worldwide regulations. Crypto companies must register with the FCA an AML supervisory board. There are also a few countries in which cryptocurrencies are banned. The specific crypto AML regulations will require crypto exchanges and custodian wallet providers to apply greater customer due diligence controls and will also require customers to be registered for the exchanges and wallets.

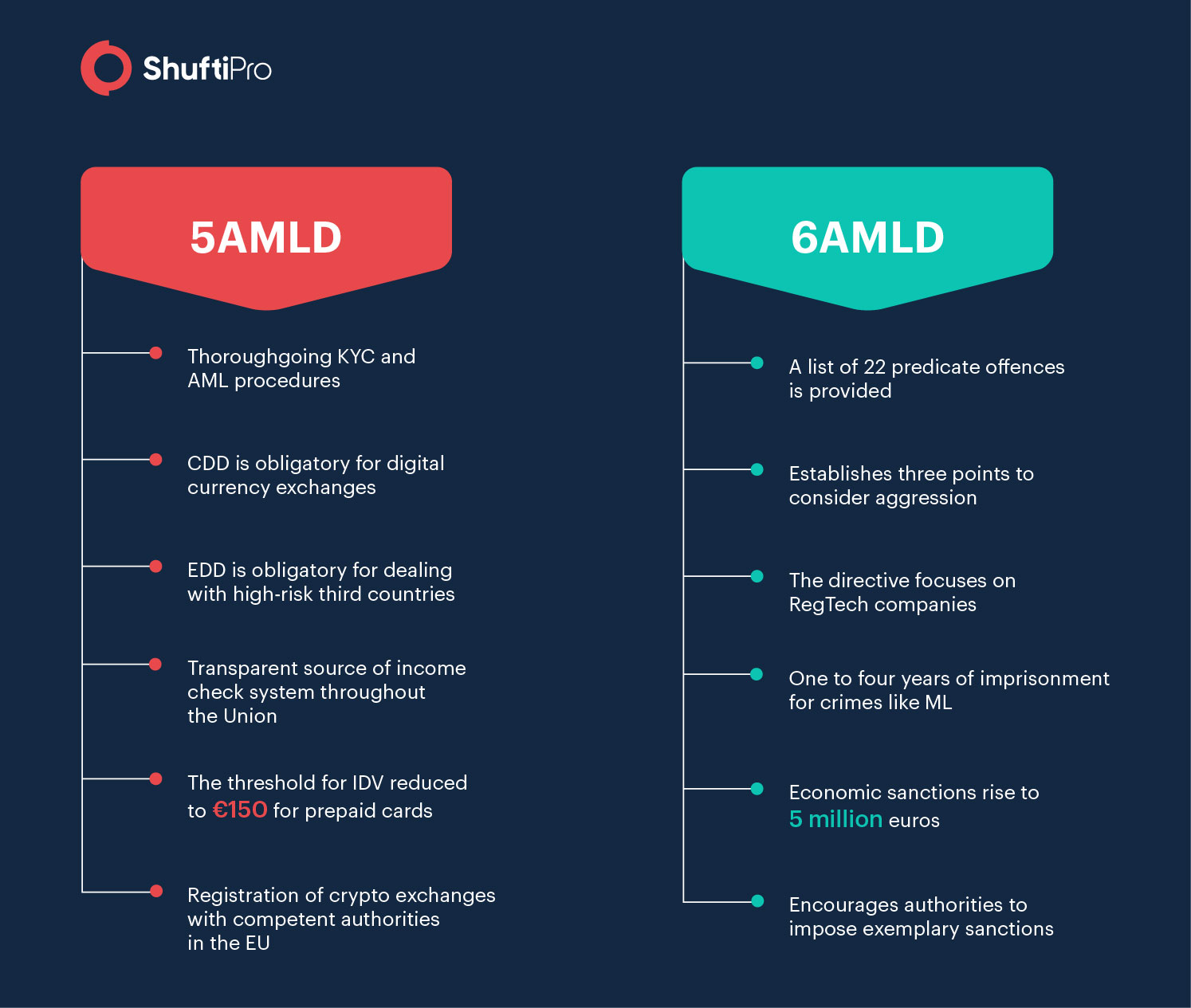

These countries include Algeria Bangladesh Bolivia Macedonia and Nepal. The EUs Fifth Anti-Money Laundering Directive 5 AMLD sets forth the AML requirements for cryptocurrency exchanges operating in the member states which they will have to comply with by 2020. 107 rows Cryptocurrencies are subject to the countrys Income Tax Act and entities dealing in.

KYC in the Crypto Niche. 107 rows Most cryptocurrencies arent backed by a central government so rules. Banks should thus integrate crypto.

The goal of the regulations is to de-anonymize cryptocurrency users as a means of fighting money laundering. What you need to. This means the implementation of an effective AML program that includes a Customer Acceptance Policy CAP a Customer Identification Program CIP ongoing monitoring of transactions and risk management procedures.

They will also have to conduct a risk assessment appoint a MLRO document internal aml policies procedures including a SAR internal processes conduct staff AML training. Even when cryptocurrency transactions take place on the regular internet there are few regulations globally. A new Fifth Directive was added to existing AML regulations in the EU.

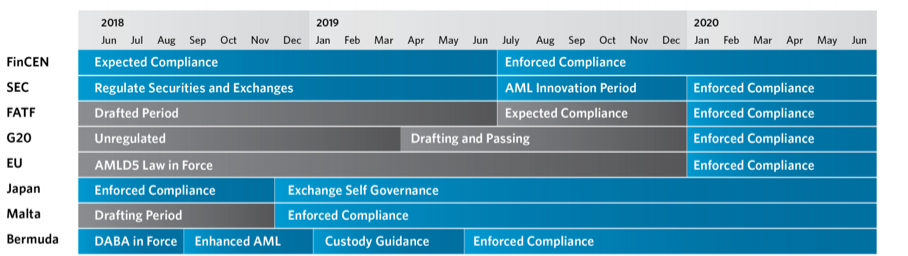

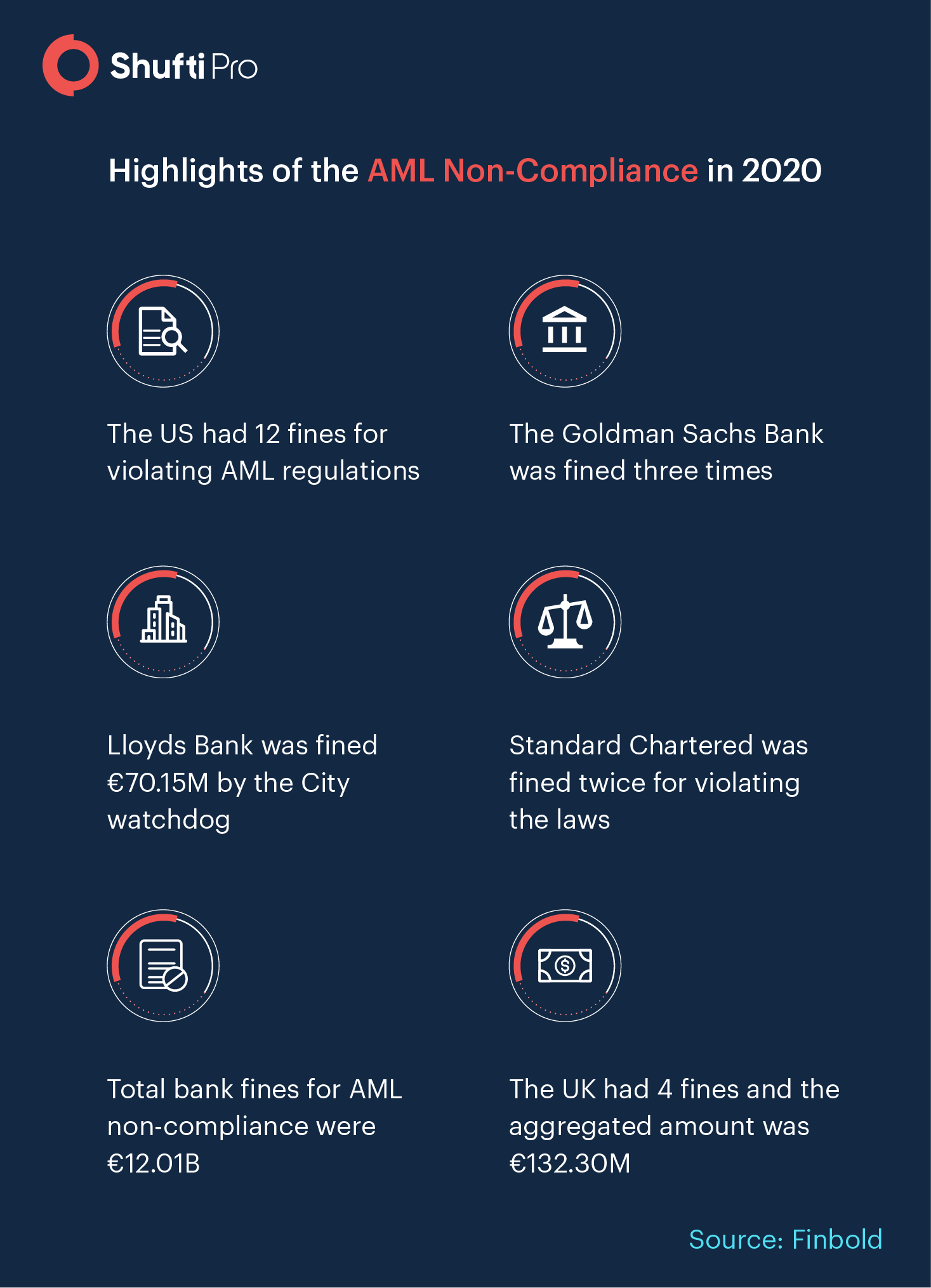

Recently many laws such as the Blockchain and Cryptocurrency Regulation in 2020 have been signed by the countrys governments which are organized to help the countrys crypto-currency businesses thrive. FinCEN in its first enforcement action of this kind imposed fines against a cryptocurrency trader for willfully violating the Bank Secrecy Act and noncompliance with standard AML practices. All these news are suggesting that big moves are likely in the global cryptocurrency regulation will pump the industry to adopt new monitoring and compliance tools in a short period of time.

The legislation known as the 5th Anti-Money Laundering Directive marks a key development in cryptocurrency regulation with the worlds second largest economy now providing clarity to cryptocurrency businesses on their anti-money laundering AML and counter-terrorism financing CTF obligations. National virtual infrastructure is overcrowded with numerous cryptocurrencies and fintech companies to help attract investors. With international regulations preventing money laundering and terrorism financing such as the FATF recommendations or Europes 6th AMLD financial institutions must adopt a risk-based approach on AMLCTF and transaction monitoring.

During 2019 regulatory bodies introduced procedures that companies engaged in the cryptocurrency market are obliged to follow. All aspects of crypto assets are therefore prohibited and in some cases even punishable by law. Many of the exchanges utilized by the general public are unregulated and not requiring additional security measures that take advantage of know your customer KYC and anti-money laundering AML procedures.

This will include conducting customer identification and verification customer due diligence keeping records monitoring for suspicious and unusual activity on an ongoing basis and reporting of suspicious transactions to the Financial. For cryptocurrency exchanges AML programs are a must both for protection against financial crime and to stay compliant with heightening regulations. The US joined countries around the world and began embracing regulation and enforcement of AML laws for virtual currencies.

This became known as AMLD5.

Cryptocurrency Money Laundering Red Flags Financial Crime Academy In 2021

New Online Course On Cryptocurrencies And Anti Money Laundering Basel Institute On Governance

New Online Course On Cryptocurrencies And Anti Money Laundering Basel Institute On Governance

Incrypted Asia 2021 In 2021 Digital Currency Top Entrepreneurs Blockchain

Addressing The Aml Risks Of Cryptocurrencies Arachnys

Cryptocurrency Money Laundering Explained Bitquery

Deribit Leaving European Aml Law Continues To Hurt Crypto Businesses Wallstreet Option Trading Cryptocurrency Future Options

Scorechain Is The First Crypto Aml Provider To Read Through Decentralized Exchanges Transactions To Prevent Money Laundering And Terrorism Financing Scorechain Blog

Anti Money Laundering Compliance For Crypto Exchanges 2021 Update

Anti Money Laundering Compliance For Crypto Exchanges 2021 Update

Infographic Of Anti Money Laundering Aml Analysis Raconteur Net Money Laundering Finance Infographic Infographic

Only 1 Week Left For Dutch Crypto Companies To Register With The Netherlands Central Bank Scorechain Blog

Stablecoins Understanding Ml Tf Risks And Regulatory Developments Scorechain Blog

Working Paper 28 Regulating Cryptocurrencies Challenges And Considerations Basel Institute On Governance

Pin By Glamkam On Laundry Business Money Laundering Evaluation Employee Employee Evaluation Form

Bitcoin Atms Undermine Eu Anti Money Laundering Efforts Says Spanish Police Btcmanager Money Laundering Bitcoin Blockchain

The Uk Us Singapore A Spotlight On The Crypto Regulations

The 2021 Guide To Aml And Kyc For Crypto Exchanges Wallets Getid